Traceloans.com Bad Credit: A Comprehensive Guide To Securing Loans With Less-than-Perfect Credit

Securing a loan with bad credit can be challenging, but it's not impossible. Traceloans.com has emerged as a potential solution for individuals with less-than-perfect credit histories. If you're struggling to find financial options that work for you, understanding how Traceloans.com operates is essential. This platform offers a unique approach to loan applications that can help you navigate the complexities of borrowing with bad credit.

In today's economic landscape, having bad credit doesn't mean you're out of options. Traceloans.com focuses on helping borrowers regain control of their finances by providing tailored loan solutions. Whether you're looking to consolidate debt, cover unexpected expenses, or invest in personal growth, this platform might just be the answer you've been searching for.

This article will explore Traceloans.com's features, benefits, and potential drawbacks. We'll also delve into strategies for improving your credit score and securing loans despite a less-than-perfect credit history. By the end of this guide, you'll have a clearer understanding of how to make informed financial decisions.

Read also:Andrew Garfields Mother A Closer Look At Her Life And Influence

Table of Contents

- Introduction to Traceloans.com Bad Credit

- Overview of Traceloans.com

- Loan Options for Bad Credit

- Eligibility Criteria for Traceloans.com

- Application Process on Traceloans.com

- Benefits of Using Traceloans.com

- Potential Risks and Drawbacks

- Improving Your Credit Score

- Alternative Loan Options

- Conclusion and Call to Action

Introduction to Traceloans.com Bad Credit

Traceloans.com is a platform designed to assist individuals with bad credit in securing loans. In the financial world, bad credit often leads to limited borrowing options. However, this platform offers a ray of hope by connecting borrowers with lenders willing to consider less-than-perfect credit histories. Understanding the nuances of Traceloans.com can empower you to make better financial decisions.

Why Traceloans.com Matters

For many, bad credit is a significant barrier to accessing necessary funds. Traceloans.com addresses this issue by providing a user-friendly interface that simplifies the loan application process. By partnering with reputable lenders, the platform ensures that borrowers receive fair treatment and transparent terms.

Overview of Traceloans.com

Traceloans.com is more than just a loan marketplace; it's a comprehensive financial solution for individuals with bad credit. The platform's primary goal is to bridge the gap between borrowers and lenders, ensuring that everyone has access to fair financial opportunities.

Key Features of Traceloans.com

- Access to multiple loan options tailored for bad credit borrowers.

- Streamlined application process with minimal paperwork.

- Connections with trusted lenders across the industry.

Loan Options for Bad Credit

Traceloans.com offers a variety of loan options specifically designed for individuals with bad credit. These loans can range from small personal loans to larger sums for significant expenses. Understanding the types of loans available can help you choose the best option for your needs.

Types of Loans Offered

- Personal Loans: Ideal for covering everyday expenses or consolidating debt.

- Payday Loans: Short-term solutions for immediate financial needs.

- Secured Loans: Backed by collateral, these loans often come with lower interest rates.

Eligibility Criteria for Traceloans.com

While Traceloans.com is designed for individuals with bad credit, there are still certain eligibility criteria that must be met. These criteria ensure that borrowers are capable of repaying their loans responsibly.

Basic Requirements

- Must be at least 18 years old.

- Have a valid source of income.

- Provide proof of residency and identity.

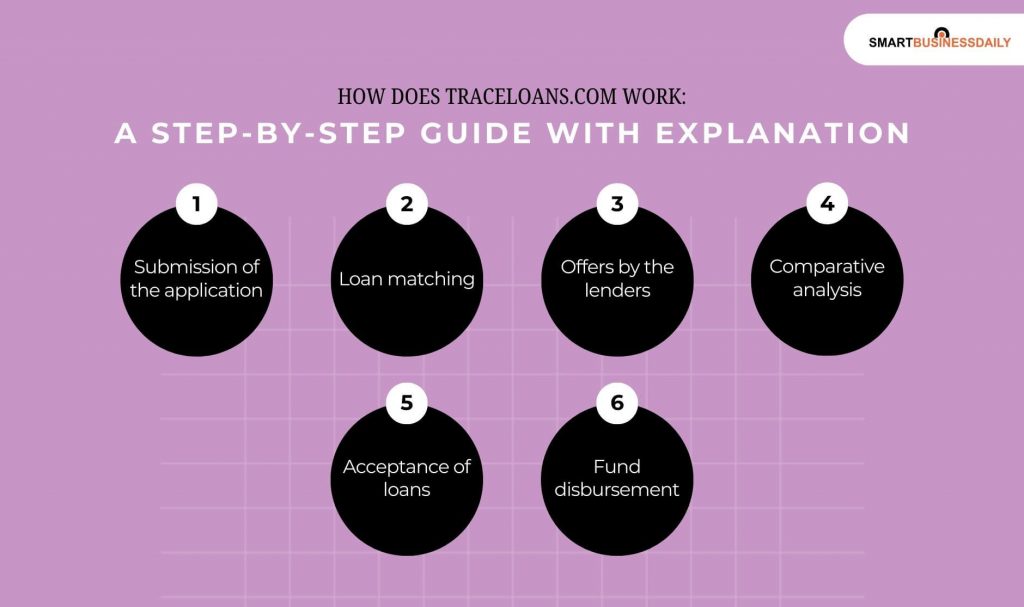

Application Process on Traceloans.com

The application process on Traceloans.com is straightforward and user-friendly. Borrowers can complete the process online, often receiving approval within a short timeframe. Understanding the steps involved can help you prepare for a smooth application experience.

Read also:Celine Dion Funeral A Celebration Of Life And Legacy

Steps to Apply

- Visit the Traceloans.com website and fill out the initial application form.

- Provide necessary documentation, such as proof of income and identification.

- Wait for lender approval and review the terms of the loan offer.

Benefits of Using Traceloans.com

Using Traceloans.com offers several advantages for individuals with bad credit. From convenience to transparency, this platform aims to make the borrowing process as stress-free as possible.

Top Benefits

- Convenience: Apply from the comfort of your home with an online platform.

- Transparency: Clear terms and conditions ensure no hidden fees or surprises.

- Flexibility: Choose from a variety of loan options to suit your financial needs.

Potential Risks and Drawbacks

While Traceloans.com offers numerous benefits, it's important to be aware of potential risks. High interest rates and strict repayment terms can make some loans less appealing. Understanding these drawbacks can help you make an informed decision.

Managing Risks

- Compare interest rates and terms with other lenders before committing.

- Create a realistic repayment plan to avoid falling behind on payments.

- Seek financial advice if unsure about the suitability of a loan.

Improving Your Credit Score

Securing a loan with bad credit is possible, but improving your credit score can open up more financial opportunities. Traceloans.com offers resources and tips to help borrowers enhance their creditworthiness over time.

Strategies for Improvement

- Pay bills on time to establish a positive payment history.

- Reduce overall debt by focusing on high-interest balances first.

- Monitor your credit report regularly for errors or discrepancies.

Alternative Loan Options

While Traceloans.com is a viable option for bad credit borrowers, there are other alternatives worth exploring. Credit unions, community banks, and peer-to-peer lending platforms may offer competitive rates and flexible terms.

Exploring Alternatives

- Credit Unions: Often provide lower interest rates and personalized service.

- Peer-to-Peer Lending: Connects borrowers directly with individual investors.

- Government Programs: Offers loans with favorable terms for specific demographics.

Conclusion and Call to Action

In conclusion, Traceloans.com offers a valuable solution for individuals with bad credit seeking financial assistance. By understanding the platform's features, benefits, and potential drawbacks, you can make informed decisions about your borrowing options. Remember to compare rates, create a solid repayment plan, and take steps to improve your credit score over time.

We encourage you to share your thoughts and experiences in the comments section below. Your feedback can help others make better financial decisions. Additionally, feel free to explore other articles on our site for more insights into managing personal finances effectively.

For further reading and reliable sources, consider visiting: