What Is The Franchise Tax Board: A Comprehensive Guide

The Franchise Tax Board (FTB) is a state agency in California responsible for administering state tax laws and ensuring compliance. It plays a critical role in collecting taxes, managing taxpayer accounts, and enforcing tax regulations to maintain the financial stability of the state. Understanding the FTB is essential for businesses, individuals, and anyone who resides or operates in California.

When it comes to taxation, the Franchise Tax Board often raises questions for both new and seasoned taxpayers. Whether you're a small business owner or an individual filing your annual tax return, knowing the intricacies of the FTB can help you avoid penalties and stay compliant with California's tax laws.

This article will delve into the details of the Franchise Tax Board, its functions, responsibilities, and how it affects taxpayers. We'll also explore common issues people face when dealing with the FTB and provide actionable advice to ensure smooth interactions with this important agency.

Read also:Exploring The Phenomenon Mike Adriano Swallowed

Table of Contents

- Introduction to the Franchise Tax Board

- History of the Franchise Tax Board

- Key Functions of the Franchise Tax Board

- Taxes Managed by the Franchise Tax Board

- Impact on Businesses

- Impact on Individuals

- Ensuring Compliance with the FTB

- Penalties for Non-Compliance

- Resources and Tools Provided by the FTB

- Frequently Asked Questions About the Franchise Tax Board

Introduction to the Franchise Tax Board

The Franchise Tax Board is a vital government entity in California that oversees tax administration and enforcement. Established to ensure the collection of state taxes, the FTB is responsible for managing individual income taxes, corporate taxes, and other related financial obligations. Its mission is to promote fairness and transparency in taxation while safeguarding the interests of both taxpayers and the state.

The FTB's primary role is to administer California's tax laws effectively. This includes processing tax returns, resolving disputes, and collecting outstanding taxes. By maintaining a robust system of checks and balances, the FTB ensures that all taxpayers fulfill their obligations in a timely and accurate manner.

Why Understanding the FTB is Important

- It helps businesses and individuals avoid unnecessary penalties.

- It ensures compliance with state tax laws, reducing legal risks.

- It provides clarity on tax obligations, leading to better financial planning.

History of the Franchise Tax Board

The origins of the Franchise Tax Board date back to the early 20th century when California recognized the need for a dedicated agency to handle tax administration. Over the years, the FTB has evolved to meet the changing demands of the state's economy and population. Today, it stands as one of the most efficient tax agencies in the United States, leveraging technology and data analytics to streamline operations.

Historically, the FTB was created to address the complexities of state taxation, particularly after the introduction of the California Personal Income Tax Act in 1935. Since then, it has expanded its scope to include corporate taxes, franchise taxes, and other revenue-generating activities.

Key Functions of the Franchise Tax Board

The Franchise Tax Board performs several critical functions that contribute to the stability of California's economy. These include:

- Processing individual and corporate tax returns.

- Collecting outstanding taxes and resolving payment disputes.

- Providing guidance and resources to taxpayers.

- Enforcing tax laws and penalizing non-compliance.

Through these functions, the FTB ensures that California maintains a balanced budget and continues to invest in public services and infrastructure.

Read also:9xmovies Gb Your Ultimate Guide To Downloading Movies Legally

How the FTB Supports Taxpayers

The FTB offers a range of services designed to assist taxpayers in understanding and fulfilling their obligations. This includes online portals, educational resources, and customer support channels. By simplifying the tax filing process, the FTB aims to create a positive experience for all users.

Taxes Managed by the Franchise Tax Board

The Franchise Tax Board oversees a variety of taxes, including:

- Personal Income Tax: Collected from individuals based on their earnings.

- Corporate Tax: Applied to businesses operating within California.

- Franchise Tax: A flat fee levied on corporations and LLCs for the privilege of doing business in the state.

Each of these taxes plays a crucial role in funding state programs and initiatives. Understanding the differences and requirements for each tax type is essential for taxpayers seeking to remain compliant.

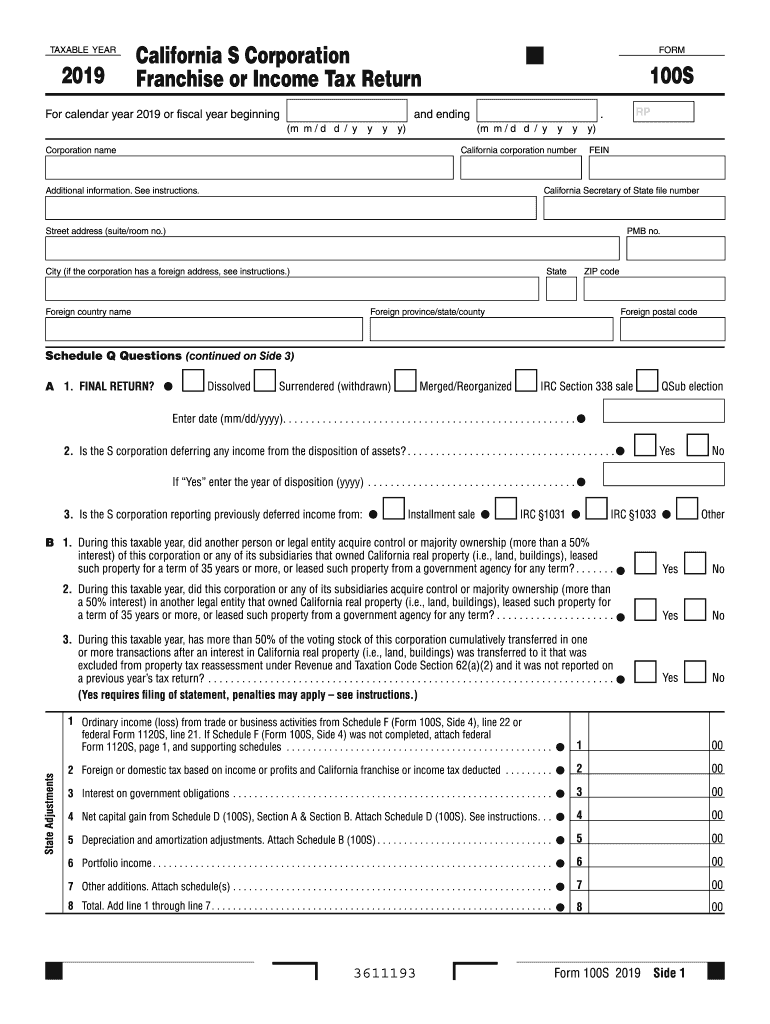

Impact on Businesses

For businesses operating in California, the Franchise Tax Board is a key player in their financial landscape. Companies must file annual tax returns and pay applicable taxes, including the franchise tax. Failure to comply can result in significant penalties and legal consequences.

Key Considerations for Businesses

- Ensure timely filing of all required tax forms.

- Stay updated on changes in tax laws and regulations.

- Utilize FTB resources to streamline tax management processes.

Impact on Individuals

Individual taxpayers in California also interact frequently with the Franchise Tax Board. From filing annual income tax returns to resolving discrepancies, the FTB provides the tools and support needed to navigate the tax system effectively.

Common Issues Faced by Individuals

- Understandable confusion over tax forms and deadlines.

- Difficulty resolving discrepancies or errors in tax returns.

- Uncertainty about deductions and credits available.

Ensuring Compliance with the FTB

Compliance with the Franchise Tax Board is essential for avoiding penalties and maintaining financial stability. Both businesses and individuals should take proactive steps to ensure they meet all tax obligations. This includes staying informed about changes in tax laws, utilizing available resources, and seeking professional advice when necessary.

Best Practices for Compliance

- Set reminders for important tax deadlines.

- Regularly review FTB updates and announcements.

- Consult with tax professionals for complex issues.

Penalties for Non-Compliance

Failing to comply with the Franchise Tax Board's regulations can result in severe penalties. These may include fines, interest charges, and legal action. To avoid such consequences, taxpayers must prioritize accuracy and timeliness in their tax filings.

Understanding Penalty Structures

The FTB imposes penalties based on the severity of the infraction. For example:

- Failure to file returns on time may result in a late filing penalty.

- Underpayment of taxes can lead to interest charges accruing over time.

- Intentional non-compliance may result in criminal charges.

Resources and Tools Provided by the FTB

The Franchise Tax Board offers a wealth of resources to assist taxpayers in managing their obligations. These include:

- An online portal for filing and managing tax accounts.

- Educational materials and guides for understanding tax laws.

- Customer support channels for resolving issues and answering questions.

By leveraging these resources, taxpayers can simplify the tax filing process and reduce the risk of errors.

Frequently Asked Questions About the Franchise Tax Board

What is the purpose of the Franchise Tax Board?

The Franchise Tax Board's purpose is to administer California's tax laws, ensuring compliance and collecting revenue to fund state programs and services.

How do I file my taxes with the FTB?

You can file your taxes through the FTB's online portal or by submitting paper forms. Ensure all required information is accurate and complete to avoid delays or penalties.

What happens if I miss a tax deadline?

Missing a tax deadline can result in late filing penalties and interest charges. It's crucial to file as soon as possible to minimize these consequences.

Can I appeal a decision made by the FTB?

Yes, taxpayers have the right to appeal decisions made by the Franchise Tax Board. The process involves submitting a formal request and providing supporting documentation.

Conclusion

In conclusion, the Franchise Tax Board plays a pivotal role in California's tax administration system. By understanding its functions, responsibilities, and impact on businesses and individuals, taxpayers can ensure compliance and avoid unnecessary penalties. The resources and tools provided by the FTB further simplify the tax filing process, making it easier for everyone to meet their obligations.

We encourage you to take advantage of the information provided in this article and apply it to your tax management strategy. For more insights and updates, explore our other articles or leave a comment below with any questions you may have. Together, let's navigate the world of taxation with confidence and clarity.