Daneric Elliott Wave: Mastering The Art Of Market Analysis

In today's fast-paced financial world, understanding market dynamics and trends is essential for traders and investors. The Daneric Elliott Wave method has emerged as one of the most powerful tools for deciphering these complexities. This comprehensive guide delves into the intricacies of Daneric Elliott Wave, providing you with everything you need to know about this transformative approach to market analysis.

Market analysis has evolved significantly over the years, and with it, so have the tools and techniques traders use to predict price movements. Among these methods, the Daneric Elliott Wave stands out as a sophisticated yet effective approach. By combining the principles of Ralph Nelson Elliott's Wave Theory with modern market insights, this technique offers unparalleled insights into market behavior.

Whether you're a seasoned trader or just starting your journey in the financial markets, mastering the Daneric Elliott Wave can enhance your trading strategies. This article will guide you through its foundations, applications, and practical implementation, equipping you with the knowledge to make informed decisions.

Read also:Lee Ha Yul A Rising Star In The Kpop Industry

Table of Contents

- Introduction to Daneric Elliott Wave

- History of Elliott Wave Theory

- Key Concepts of Daneric Elliott Wave

- Practical Application

- Common Mistakes to Avoid

- Daneric Elliott Wave in Modern Markets

- Tools for Daneric Elliott Wave Analysis

- Case Studies

- Tips for Beginners

- Conclusion

Introduction to Daneric Elliott Wave

The Daneric Elliott Wave is an advanced adaptation of the original Elliott Wave Theory, which was developed by Ralph Nelson Elliott in the 1930s. This method focuses on identifying repetitive patterns in market price movements, enabling traders to anticipate future trends with greater accuracy.

Understanding the Basics

At its core, the Daneric Elliott Wave is based on the premise that market movements follow a predictable rhythm. This rhythm consists of five waves in the direction of the main trend, followed by three corrective waves. By understanding these patterns, traders can better position themselves for optimal entry and exit points.

Why Daneric Elliott Wave Stands Out

What sets the Daneric Elliott Wave apart is its emphasis on integrating modern market conditions with traditional wave principles. This adaptation ensures that the method remains relevant in today's rapidly changing financial landscape.

History of Elliott Wave Theory

Ralph Nelson Elliott first introduced the Elliott Wave Theory in the early 20th century. His groundbreaking work revealed that market prices move in repetitive cycles, driven by investor psychology and external influences.

Key Milestones in Elliott Wave Theory

- 1930s: Elliott observes recurring patterns in stock market data.

- 1940s: Publication of "The Wave Principle," laying the foundation for modern wave analysis.

- 1970s: Renewed interest in Elliott Wave Theory among traders and analysts.

Key Concepts of Daneric Elliott Wave

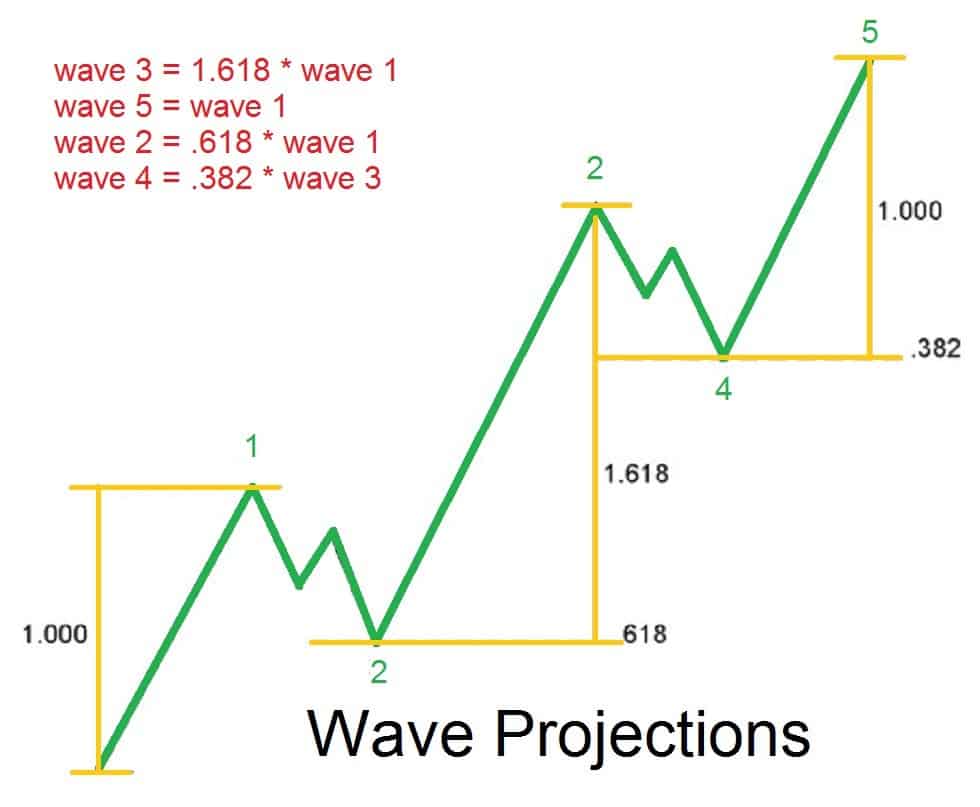

To fully grasp the Daneric Elliott Wave, it's crucial to understand its fundamental concepts. These include impulse waves, corrective waves, and Fibonacci relationships.

Impulse Waves

Impulse waves are the driving force behind the main trend. They consist of five sub-waves, labeled as 1-2-3-4-5, and move in the direction of the larger trend.

Read also:Unveiling The Fascinating World Of Penelope Memchaca

Corrective Waves

Corrective waves, on the other hand, move against the main trend. These waves typically consist of three sub-waves, labeled as A-B-C, and serve to balance the market's overall movement.

Practical Application

Applying the Daneric Elliott Wave in real-world trading scenarios requires a systematic approach. Here's how you can implement this method effectively:

Step-by-Step Guide

- Identify the main trend of the market.

- Locate the beginning of an impulse wave sequence.

- Analyze corrective waves for potential entry points.

- Use Fibonacci retracements to confirm wave structures.

Common Mistakes to Avoid

Even experienced traders can fall into pitfalls when using the Daneric Elliott Wave. Here are some common mistakes to watch out for:

Mislabeling Waves

Mislabeling waves is one of the most frequent errors. Ensuring proper wave counting is essential for accurate analysis.

Overcomplicating the Process

Overanalyzing minor fluctuations can lead to confusion. Stick to the main principles of the Daneric Elliott Wave for clarity.

Daneric Elliott Wave in Modern Markets

In today's digital age, the Daneric Elliott Wave continues to evolve. Advances in technology have made it easier to apply this method across various asset classes, including stocks, forex, and cryptocurrencies.

Adapting to New Market Conditions

Market volatility and the rise of algorithmic trading present unique challenges. The Daneric Elliott Wave addresses these by incorporating real-time data and advanced analytical tools.

Tools for Daneric Elliott Wave Analysis

Several tools and platforms assist traders in utilizing the Daneric Elliott Wave effectively. These include charting software, Fibonacci calculators, and automated wave-counting systems.

Popular Software

- MetaTrader: Offers customizable Elliott Wave indicators.

- TradingView: Provides interactive charts for wave analysis.

Case Studies

Examining real-life examples can provide valuable insights into the effectiveness of the Daneric Elliott Wave. Below are two case studies illustrating its application:

Case Study 1: Stock Market Rally

During a significant stock market rally, traders using the Daneric Elliott Wave successfully identified key resistance levels, enabling them to capitalize on upward momentum.

Case Study 2: Cryptocurrency Correction

In the cryptocurrency market, the Daneric Elliott Wave helped predict a major correction, allowing traders to mitigate potential losses.

Tips for Beginners

For those new to the Daneric Elliott Wave, here are some practical tips to get started:

Start with the Basics

Understand the core principles of wave theory before diving into advanced techniques.

Practice Regularly

Regular practice using historical data can improve your wave-counting skills and confidence.

Conclusion

The Daneric Elliott Wave offers a robust framework for analyzing market movements and making informed trading decisions. By mastering its principles and avoiding common pitfalls, traders can enhance their profitability and adapt to evolving market conditions.

We encourage you to share your thoughts and experiences with the Daneric Elliott Wave in the comments below. Additionally, explore other articles on our site to further enrich your trading knowledge.

Data and references sourced from reputable financial publications such as Investopedia and TradingView.